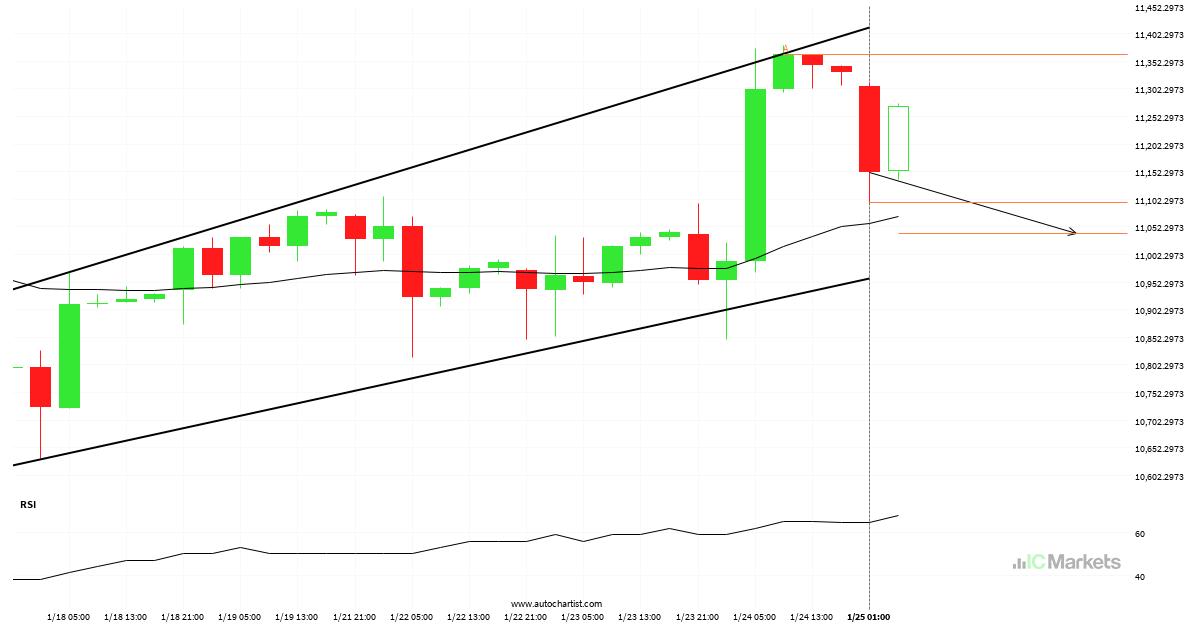

Should we expect a bullish trend on FTSE China A50 Index?

The price of FTSE China A50 Index in heading in the direction of 11567.7598. Despite the recent breakout through 11518.8604 it is possible that it will struggle to gain momentum to the forecast price and move back in the other direction. This has happened many times in the past so watch for a possible bounce […]

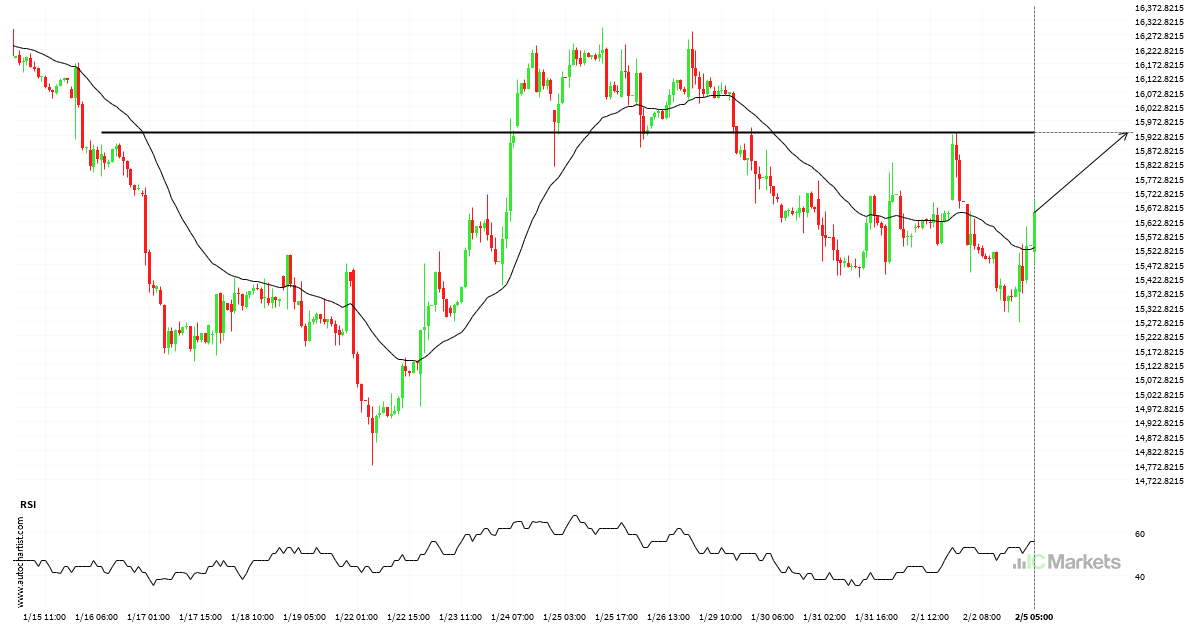

Should we expect a bullish trend on Hong Kong 50 Index?

Hong Kong 50 Index has breached the resistance line at 15933.6104. It may conitnue the bullish trend towards 16530.4063, or, it may prove to be yet another test of this level.

A potential bullish movement on Hong Kong 50 Index

A strong resistance level has been identified at 15933.6104 on the 1 hour Hong Kong 50 Index chart. Hong Kong 50 Index is likely to test it soon.

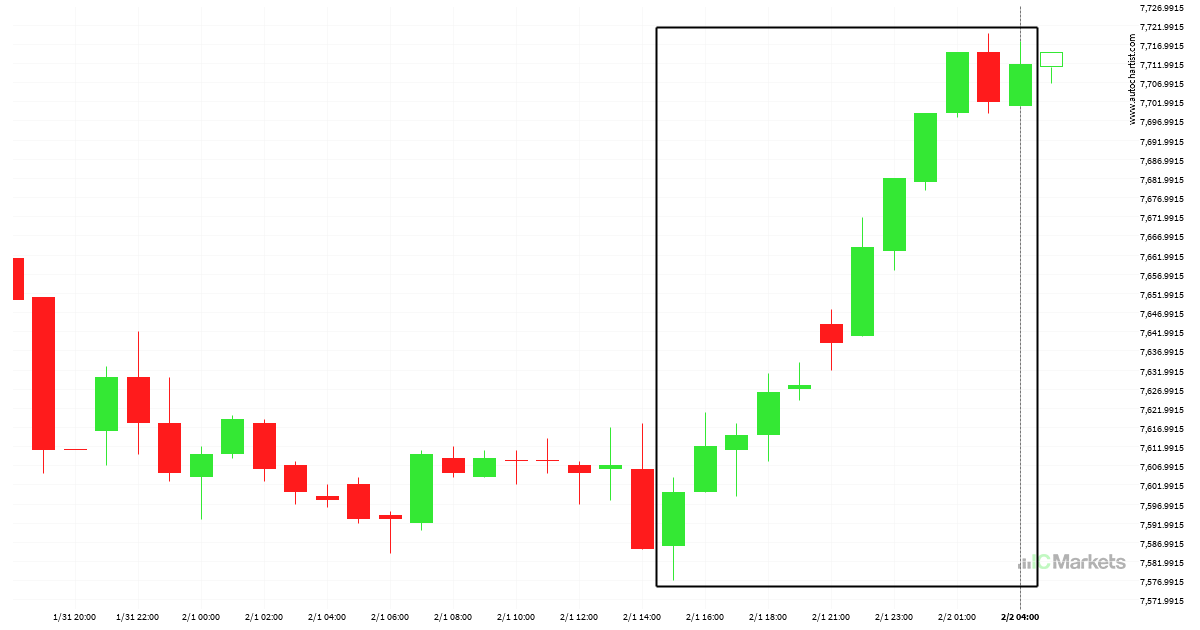

Australia 200 Index experienced an exceptionally large movement

Australia 200 Index hits 7711.85 after a 1.47% move spanning 13 hours.

Hong Kong 50 Index approaching support level

A strong support level has been identified at 15548.4502 on the 15 Minutes Hong Kong 50 Index chart. Hong Kong 50 Index is likely to test it soon.

Possible breach of resistance level by Australia 200 Index

Emerging Channel Up pattern in its final wave was identified on the Australia 200 Index 1 hour chart. After a strong bullish run, we find Australia 200 Index heading towards the upper triangle line with a possible resistance at 7679.0800. If the resistance shows to hold, the Channel Up pattern suggests a rebound back towards […]

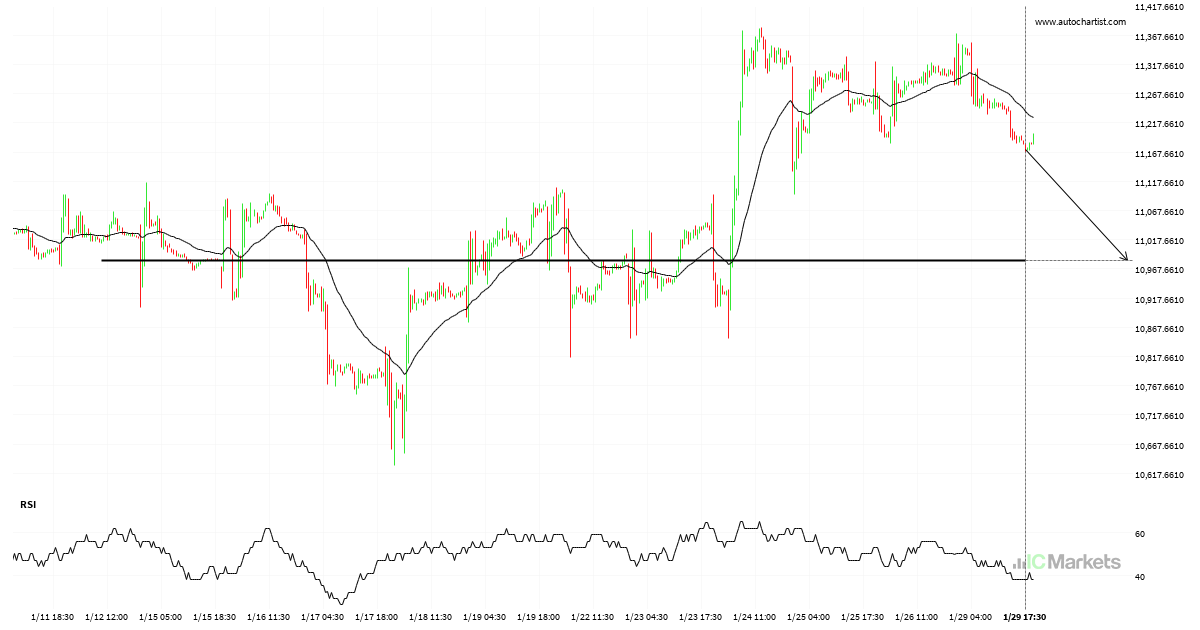

FTSE China A50 Index approaches important level of 10982.5195

FTSE China A50 Index is en route to a very important line that will be a definite deciding factor of what is to come! We may see this trajectory continue to touch and break through 10982.5195, unless it runs out of momentum and pulls back to current levels.

A potential bullish movement on Australia 200 Index

Australia 200 Index is trapped in a Rising Wedge formation, implying that a breakout is Imminent. This is a great trade-setup for both trend and swing traders. It is now approaching a support line that has been tested in the past. Divergence opportunists may be very optimistic about a possible breakout and this may be […]

Will Australia 200 Index have enough momentum to break resistance?

An emerging Rising Wedge has been detected on Australia 200 Index on the 4 hour chart. There is a possible move towards 7623.5088 next few candles. Once reaching support it may continue its bullish run or reverse back to current price levels.

Either a rebound or a breakout imminent on FTSE China A50 Index

FTSE China A50 Index is heading towards the support line of a Flag and could reach this point within the next 2 days. It has tested this line numerous times in the past, and this time could be no different from the past, ending in a rebound instead of a breakout. If the breakout doesn’t […]